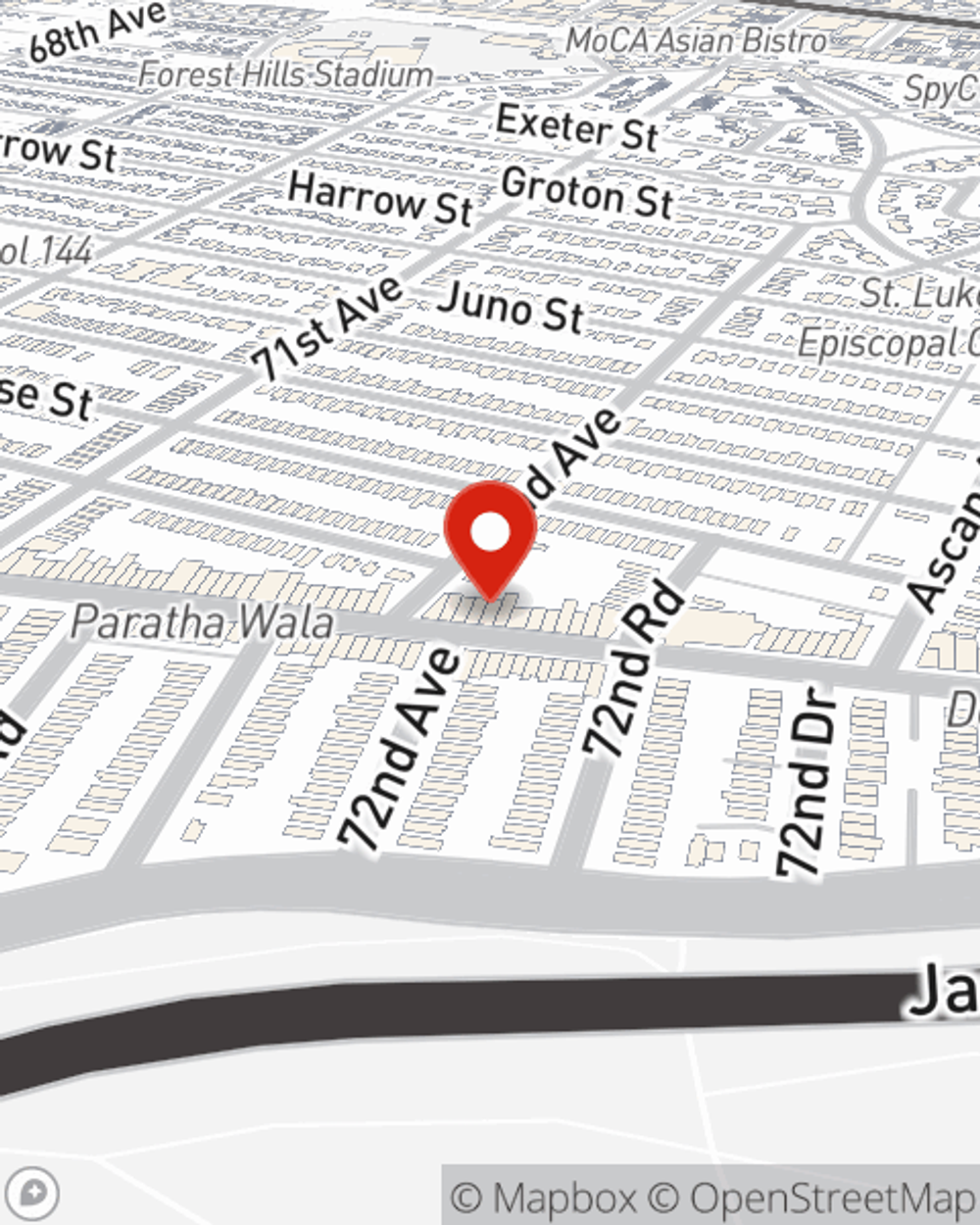

Condo Insurance in and around Forest Hills

Condo unitowners of Forest Hills, State Farm has you covered.

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Your condo is your safe place. When you want to catch your breath, unwind and rest, that's where you want to be with the ones you love.

Condo unitowners of Forest Hills, State Farm has you covered.

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

That’s why you need State Farm Condo Unitowners Insurance. Agent Mike Tighe can roll out the welcome mat to help create a policy for your particular situation. You’ll feel right at home with Agent Mike Tighe, with a straightforward experience to get high-quality coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Mike Tighe can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Contact Mike Tighe's office today to find out the advantages of Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Mike at (718) 358-3939 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.